Finowo is building PSD2-compliant payment infrastructure under the Polish KNF license — merging regulatory expertise with modern API-first technology to empower fintechs, marketplaces, and SaaS platforms across Europe.

Solutions Designed for Scale

and Compliance

Finowo is building payment infrastructure to power modern businesses across verticals.

Marketplaces & Payouts

Enable split payments, escrow, and automated multi-party disbursements with full regulatory oversight and reconciliation.

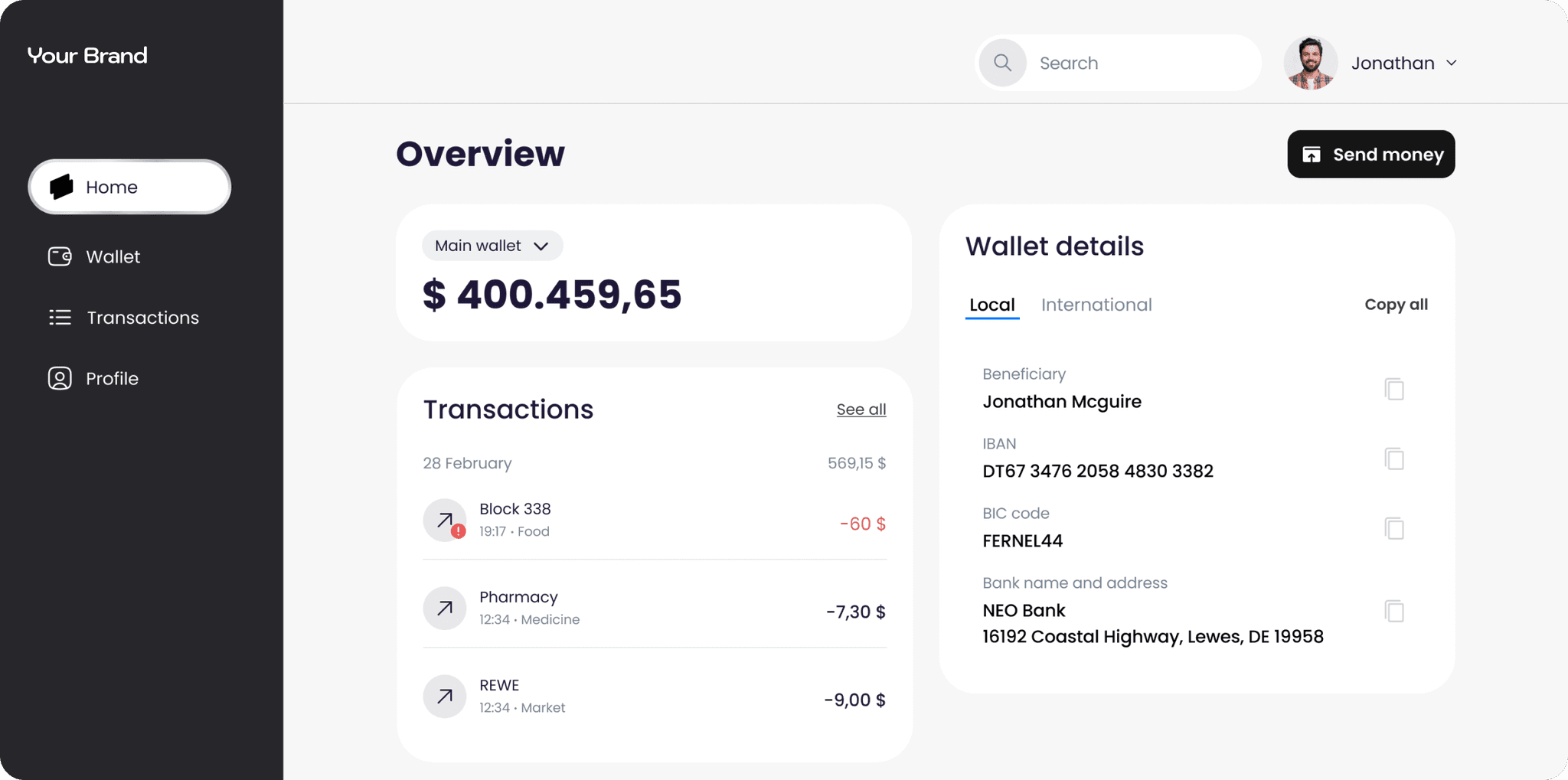

Fintech & Digital Wallets

Support neobanks, digital wallets, and payment applications with pre-built compliance modules and secure account infrastructure.

Embedded Finance

Allow integration of payment capabilities into SaaS or vertical platforms, enabling seamless financial experiences.

Payroll & Disbursements

Enable split payments, escrow, and automated multi-party disbursements with full regulatory oversight and reconciliation.

Identity Verification

Enable secure onboarding and verification with integrated KYC/KYB, AML screening, and risk assessment tools.

Compliance Automation

in Development

KYC & KYB Verification Workflows

Streamlined identity verification and business onboarding with automated document checks, risk scoring, and regulatory compliance workflows.

Automated KYT & AML Screening

Planned real-time KYT (Know Your Transaction) monitoring and screening against global sanctions lists, PEP databases, and adverse media sources with configurable risk thresholds.

Real-Time Transaction Monitoring (KYT)

Designed to automatically flag high-risk transactions and customers based on transaction patterns, velocity checks, jurisdiction risks, and behavioral analysis for enhanced due diligence.

Operational Efficiency Target

Architecture designed to reduce manual review time and operational overhead while improving accuracy and audit readiness.

Enterprise-Grade Security Standards

Finowo ensures bank-level protection with AES-256 encryption, EU-based data centers compliant with ISO 27017 and GDPR, and a resilient infrastructure engineered for 99.99% uptime and continuous monitoring.